One cost line is sinking, the price of producing electricity from the sun. Another is rising—the tariff Filipino consumers pay every month. The two lines are racing toward a meeting point that energy analysts call the crossover. When they cross, owning rooftop panels will be cheaper than relying on the grid. Across the archipelago, interest in solar energy Philippines is accelerating as installation costs slide and household tariffs climb. This article tracks the technology breakthroughs, market numbers, and policies pushing the country toward that tipping point.

1. Solar Prices Keep Sliding

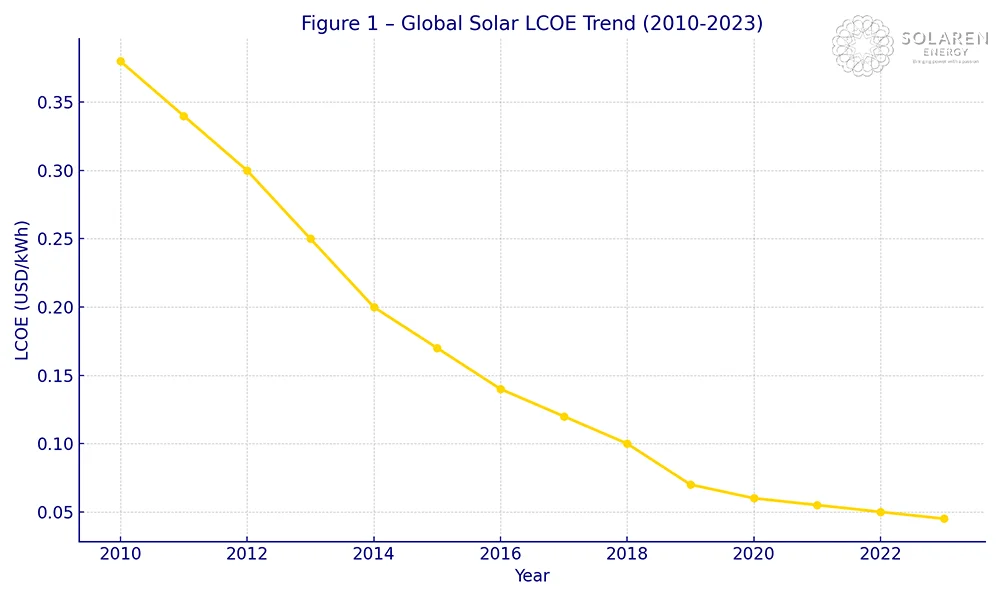

The global levelised cost of energy for utility‑scale solar plunged from USD 0.38 /kWh in 2010 to just USD 0.044 /kWh in 2023. The Philippines rides the same curve. Three forces drive this fall:

- Massive acceleration of Factory production scale in China and Southeast Asia.

- Steady cell‑efficiency gains are squeezing more watts out of less silicon.

- Competitive auctions are forcing suppliers to shave margins.

What does LCOE measure? It bundles every peso from modules and land to labour and finance into a lifetime cost per kilowatt‑hour. The International Renewable Energy Agency audits hundreds of projects each year, so the trend is no marketing gimmick. At current prices, ground‑mount solar already beats new coal, gas, and diesel units on a pure cents per kilowatt‑hour basis.

Large Corporations now sign 20‑year solar PPAs at PHP 4.50 /kWh, far below the daytime spot price. Those contracts rapidly accelerate new projects and create scale efficiencies that spill over to rooftop buyers. Once the crossover arrives, retail customers will enjoy the same economics without needing a long‑form power‑purchase agreement.

Long before today’s pricing and efficiency gains, early commercial rooftop systems were already proving that solar economics could work in the Philippines. One of Solaren’s earliest retail installations shows how systems built under far higher module, inverter, and balance-of-system costs continue to deliver stable output years later, even without the advantages of modern panel and inverter technology.

2. Electricity Bills Keep Rising

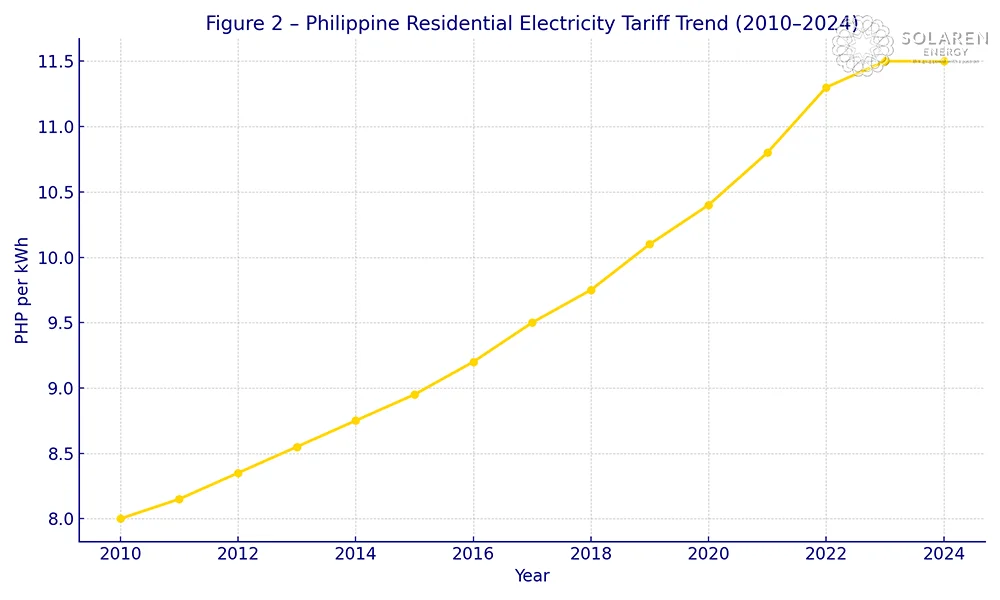

While panels grow cheaper, household tariffs marched from PHP 8.0 /kWh in 2010 to about PHP 11.6 /kWh in 2024. Four structural issues explain the rise:

- Imported fuel: Over half of the current generation burns coal or LNG priced in US dollars.

- Island grid: An archipelago needs many small plants and costly submarine cables.

- Legacy contracts: Capacity fees signed in the 1990s sit on bills even when generating plants sit idle.

- Taxes & levies: VAT, universal charges, and subsidies add more than twelve percent.

The widening gap between a falling solar curve and a rising utility curve makes the energy crossover inevitable. Wages and food prices in Manila remain far below Asian counterparts, which have equivalent power rates. In the Philippines, each additional peso on a power bill bites harder, accelerating the necessity for both commercial and household solutions

3. Panel Technology Continues to Move Fast

Hardware upgrades shorten payback times every single year.

Efficiency leaps: N‑type TOPCon cells roll off production lines at twenty‑five percent efficiency—a full ten points above standard p‑type modules from a decade ago.

More light captured: Bifacial glass‑glass panels harvest sunlight on both faces and boost yield by up to thirty percent when installed over pale concrete or white TPO roofs.

As an example, a 680kWp rooftop in Laguna replaced ageing monofacial panels with bifacial modules in 2024. Yield jumped nineteen percent year‑on‑year without adding a single additional square meter of modules. Management coated the roof with high‑albedo paint for PHP 160,000; the reflective layer alone added another 3 percent output, cutting the blended payback from seven years to four. The example shows how simple tweaks turbo‑charge the solar energy the Philippines returns.

More recent retail rooftop projects benefit directly from these advances, combining higher-efficiency modules, improved inverter controls, and better system integration from the outset. A newer food-service installation demonstrates how modern design standards shorten payback periods and improve year-one performance compared with earlier-generation systems built a decade ago.

4. Smarter Inverters and “Balance‑of‑System” Components

Innovations reach far beyond the module advances.

- Twelve or more MPPT string inverters map shade in real time, letting designers use every odd‑shaped and previously unusable roof section.

- 1500 V DC strings cut cable losses by two percent, allow slimmer conductors and significantly reduce wire costs.

- Built‑in rapid‑shutdown meets the latest Philippine Electrical Code requirements.

- Per‑panel monitors stream harvest data to phone dashboards, so owners and EPC’s can spot faults before yield suffers.

- Aluminium‑zinc rail coatings double the rack life compared with raw steel. Especially crucial in coastal provinces.

- Pre‑assembled “Home run” plug‑and‑play harnesses now clip together on the roof, cutting labour hours by twenty percent and improving job‑site safety.

Stack just these few micro‑improvements together and a modern 100 kW array can produce over 15,000 kWh more each year than an early‑2010s system of the same size.

5. Battery Storage Deployment Surges

Daylight ends at sunset, yet batteries carry surplus power into the evening peak. The Department of Energy’s Green Energy Auction now pairs solar bids with battery energy‑storage systems (BESS). Commissioned capacity leapt from 83 MWh in 2022 to 800 MWh in 2024, and based on projects already under construction plus DOE approvals, is on track to pass and incredible 1400MWh by the end of 2025.

Why is storage booming?

- Lithium‑ion cell prices fell by seventy‑five percent between 2015 and 2025. Sliding from around USD350 per kWh to just under USD90 per kWh

- Evening retail tariffs run a full four pesos above midday rates.

- Outage frequency in provincial grids makes self‑reliance valuable.

Revenue stacking: New rules let battery owners earn three revenue streams: 1) peak‑shifting savings, 2) ancillary‑service payments for frequency response, and 3) export sales during high‑price hours. A 2 MWh battery in Pampanga captured PHP 9 million gross in its first 12 months—a payback faster than spreadsheets predicted.

Safety counts: Modern BESS packs comply with UL 9540 and IFC 1207 fire codes. Integrated smoke vents, and battery‑management systems isolate runaway cells within milliseconds, while containerized fire-retardant tanks offer twenty‑minute suppression.

6. How Philippine Tariffs Compare with Asia

Latest household rates (USD /kWh):

- Singapore 0.249

- Philippines 0.207

- Japan 0.201

- Indonesia 0.086

Electricity represents a ridiculously disproportionate cost in Manila. Lower wages magnify each extra peso. Singapore and Japan absorb high tariffs with GDP per‑capita above USD 40,000; Filipino incomes hover around USD 4,200. That ten‑to‑one gap makes energy inflation far more painful locally and raises the urgency of switching to rooftop generation systems.

An example: In Quezon City, a mid‑rise condominium retrofitted 300 kW of rooftop PV across three towers in 2023. The residents’ association financed the project through a green mortgage surcharge of only PHP 1,200 per unit each month. Twelve months of metering data show common‑area consumption dropped seventy‑eight percent, cutting association dues by PHP 3,400 per homeowner and generating positive cash flow from the second month. The success has sparked copy‑cat schemes in Cebu and Davao, proving that urban density need not block the roll‑out of the much-touted solar energy Philippines in multi‑owner buildings.

7. Policy Signals Speed the Transition

Regulators have accelerated the trend. Key milestones:

- Renewable Energy Act targets: 35 percent renewable share by 2030 and 50 percent by 2040.

- Foreign‑ownership reform (2023): Full foreign control allowed for renewable projects, unlocking vast amounts of capital.

- Net‑billing clarity (2024): Export credits now tied to wholesale spot prices, boosting bankability.

- Solar‑ready roofs: proposed building code changes will mandate conduit pathways and south‑facing space.

- Local‑government ordinance: Quezon City and Iloilo now offer property‑tax rebates for compliant installations.

- Green Energy Auction 2: awarded 3 GW of PV plus storage at record‑low tariffs of PHP 4.48 /kWh.

Each of these measures nudges investment toward self‑generation and storage, accelerating the adoption of mandated “solar energy Philippines” systems.

8. Four Trends to Watch Next

- Grid‑forming inverters will let PV plants stabilise frequency without spinning turbines.

- Second‑life EV batteries will slash storage costs for island micro‑grids.

- Virtual power plants. It is now possible to aggregate thousands of rooftops into dispatchable capacity.

- Carbon pricing legislation would raise fossil‑fuel costs and push the crossover earlier.

- Floating and agrivoltaic arrays are moving from pilot to commercial scale, expanding usable surface without competing for costly land.

Carbon pricing outlook – Lawmakers are examining a tiered carbon levy modeled on Singapore’s SGD 25 per‑tonne charge and Indonesia’s draft IDR 30,000 scheme. Even a modest PHP 200 levy would lift coal generation costs by roughly PHP 1.30 /kWh, erasing the last price edge of legacy plants. Because the fee would phase in over three years, developers are fast‑tracking pipelines to lock in pre‑levy PPAs. If enacted, the Philippines will become the third ASEAN country with a national carbon price, sending lenders a clear signal that solar energy Philippines projects carry less policy risk than fossil alternatives. Taken together, these signals mark the dawn of a new solar decade.

If these forces align, solar energy Philippines will dominate with significant new capacity additions well before 2030.

Video

How Solar Energy Got So Cheap – Vox

Frequently Asked Questions

Q1. When will rooftop solar beat grid prices for most homes?

Most studies point to 2026–2027 on Luzon and even sooner on island grids.

Q2. Are N‑type panels worth their higher cost?

Yes. Greater efficiency and slower degradation recover the premium within three to four years, especially on tight roofs.

Q3. How long do lithium‑ion batteries last in tropical climates?

With air‑conditioned enclosures, modern packs hold 80 percent capacity for 10–12 years under daily cycling.

References and Useful Resources

- IRENA – Renewable Power Generation Costs 2023.

https://www.irena.org/publications/2024/Jun/Renewable-power-generation-costs-in-2023 - BloombergNEF – Battery Pack Prices Fall to Record $139/kWh.

https://about.bnef.com/blog/battery-pack-prices-fall-to-record-139-per-kwh/ - GlobalPetrolPrices.com – Electricity Prices in Philippines.

https://www.globalpetrolprices.com/Philippines/electricity_prices/ - Reuters – Philippines, UAE’s Masdar Agree $1.5 B Renewable‑Energy Project (16 Jan 2025).

https://www.reuters.com/sustainability/climate-energy/philippines-uaes-masdar-agree-15-bln-renewable-energy-project-2025-01-16/